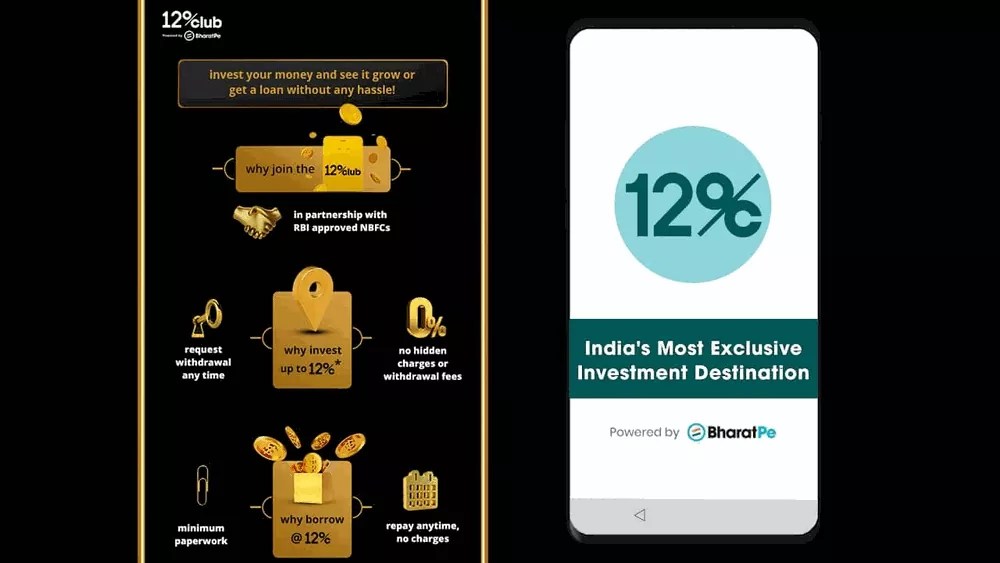

As compensation, they BharatPe manages the 12 club p2p, a platform that allows investors and borrowers to borrow money. One of India’s top Fintech companies is the 12 Club bharatpe peer-to-peer lending platform. If you invest at 12%, you might receive at least 12% interest.

With the introduction of its product, peer-to-peer lending company 12 Club bhratpe grows. Consumers are the target audience for the game, which examines the financial services and merchant payments industries.

Individual investors will be able to borrow money at 12% percent thanks to 12 club bharatpe and the 12 club p2p.

Start earning up to 12% interest on your investments! Download Now

Liquiloans are now recognised on the Club BharatPe network as a part of the client solution that LenDenClub and 12 Club BharatPe jointly created.. In 2019, the fintech startup offered its merchants peer-to-peer loans through the same partners.

P2P investors would give loans to its merchants on the 12 club p2p platform in order to keep delinquencies to a low.

The corporation asserted that it will be able to analyse these loans more thoroughly utilising corporate cash flows because these stores accept payments via the BharatPe system. The company also disclosed that daily reimbursements for a little amount would be taken to help pay off this debt.

Reputable non-financial companies like Hindon Mercantile would promote borrowing on the 12 club bhratpe by providing loans to their consumers.

12 club bharatpe p2p lending had first Started

We believe the 12 club p2p is a wise decision because it avoids the significant dangers associated with stock investing. This month, we soft launched the product. Members also have the option to reject the offer at any time. Concentration when lending to a small cohort is not a concern because 12 club bhratpe p2p lending has millions of merchants.

Grover claims that the typical loan term on the platform will be between three and twelve months.

The 12 club bharatpe presently receives $5 million from private investors each month, and loans totaling $1 million have been made.

The majority of the increase has come from referrals, however the company estimates that the programme receives close to enter the $2.85 billion unicorn league, which is highly sought after in India.

For 12 Club Bharatpe P2P Lending, a new investor from New York named Tiger Global Management headed a $370 million primary and secondary investment round.

What is P2P lending?

- 12 club bharatpep2p lending lending is not a new feature.

- In 2017, the Reserve Bank of India had brought this service under its regulatory purview.

- Even at the time. There were more than 20, 12 club P2P lending players in the market but RBI’s regulations ensured only the serious ones with watertight business models remained in the sector.

- In p2p lending, users sitting on idle money provide loans to potential borrowers identified by the service provider.

- These 12 club bharatpe p2plenders then receive payments from the borrowers on a set basis — either one time or in equated monthly instalment.

- After RBI issued its regulations in 2017, the space saw a spree of fundraising

- 12 club bhratpe Involving some of the existing players in the segment.

- Some of the major companies operating in this space include RupeeCircle, Finzy, IndiaMoneyMart, etc.

Start earning up to 12% interest on your investments! Download Now

What are the risks?

- One of the biggest risks associated with this kind of lending is the non-repayment of loans.

- Given that 12 club bharatpe p2p lending is a form of unsecured loan. The borrower has not provided a guarantee for the lender to repay in the event of a default.

- However, the unsecured nature of the loan is also the reason behind the high return on investment.

Start earning up to 12% interest on your investments! Download Now

About 12 club Bharatpe p2p lending?

- “Consumers on the 12 club can invest their savings anytime by choosing to the lend money through partner

- Additionally, a consumer can avail collateral free loans of up to Rs. 10 lakh on the 12 % for a tenure of 3 months, as per their convenience, the statement said.

- There will be no processing charges or pre-payment charges on the consumer loans,

- The loan eligibility would be determined by various factor, so it also added.

- Including consumer’s credit score, shopping history using Payback loyalty system or the payments done via BharatPe

- Consumers investing via app can put in a request to withdraw their investment anytime, partially

- Or completely, without any withdrawal charges.

- At present, the upper limit for individual investment is Rs. 10 lakh.

- This would increased to Rs. 50 lakh over the next few months.

Start earning up to 12% interest on your investments! Download Now

Conclusion

The launch of 12 club Bharatpe P2P lending by 12%club is a shining example of the cutting-edge services that financial technology businesses aspire to provide. You can keep captive audiences inside the ecosystem by allowing people to earn money and borrow money at rates that are competitive with the market.